Plymouth Foundation is a registered IRS 501(c)(3) charity, acts as shadow Town government according to research

Foundation listed on Town website, taxpayers fund staff salaries according to IRS filings

Foundation stacked with developers, 3 town employees, makes land deals with the Town

Foundation violating Open Meeting Law says CLWC complaint

Background

This post explores the who, what, and why behind the secretive “Plymouth Foundation.” The Foundation recently rebranded itself – it was founded in 2001 as the “Plymouth Regional Economic Development Foundation”. Check out its new website: www.plymouth-ma.biz

Is the Foundation a shadow government working hand in hand to siphon Town owned land into the hands of developers for private profit?

The Foundation claims “Our work preserves the character of our community and enriches quality of life in Greater Plymouth, Massachusetts.”

But the Foundation is involved in sand and gravel mining deals. Is this preserving our community?

In 2005, the Town sold 23 acres of public land to the Foundation which then conducted a sand and gravel mining operation. Read about the Foundation’s sand mining at 103 Hedge’s Pond Road (Cantor Court) on SandWars.org and on this blog.

In 2022, the Plymouth Select Board sold more Town land to the Foundation — 33 acres for $1.00. The land is part of the Cedarville Conservation Area. The Town Planning and Development Department told Town Meeting that 134 acres would be put into conservation in exchange for the 33 acre sale. The 134 acres is not in conservation. Now the Foundation is making a deal to sell the 33 acres for $4.2 million to one of the region’s largest sand and gravel mining operators, EJ Pontiff. Read the blog: “Just say NO to New Sand Mine in Cedarville Conservation Area.”

Foundation registered IRS 501c3 charity

The Foundation is an IRS 501(c)(3) charity. This allows the Foundation to be exempt from paying taxes on money it makes. There are serious questions about whether the Foundation is unlawfully claiming “tax exempt” status. Read more below.

The Foundation’s charity tax returns are posted on the state Attorney General’s Office, Public Charities Division. See the tax returns from 2004 to 2023 here.

The Foundation’s tax returns show it generated income from sand and gravel mining. Is it legal for a charity to conduct sand and gravel mining to generate income for itself? Was the income generated by mining on Hedges Pond Road at the Cantor Court site?

Below: Example of Foundation’s IRS 990 tax return showing income from “sand and gravel sales” in 2008 and 2009.

On its 2022 IRS 990 tax returns the Foundation listed a website called “econdevtownhall.plymouth.ma”. This website is supposed to be the place where the public can find the Foundation’s records and reports. The website is defunct. Where are the records?

A shadow government?

The Foundation has all the features of a “government body” — but operates in the shadows behind closed doors in meetings with the developers on the board and the three town officials — making sand mining deals and selling land. The Foundation’s website mimics the Town website: “plymouth-ma.biz” much like the official Town website “plymouth-ma.gov“.

The Town website features the Foundation prominently with a “Quick Link” and then identifies the Foundation’s Executive Director as “staff” of the Planning & Development Department. The Town website shows this below.

Then, the Town Planning and Development website lists “Economic Development & Tourism“:

Then the Town’s Economic Development & Tourism page lists Plymouth Foundation executive director Stephen Cole in the “Staff Directory”. As shown below, the Town website leads the public to believe the Executive Director of the Plymouth Foundation has an office at Plymouth Town Hall, 26 Court Street.

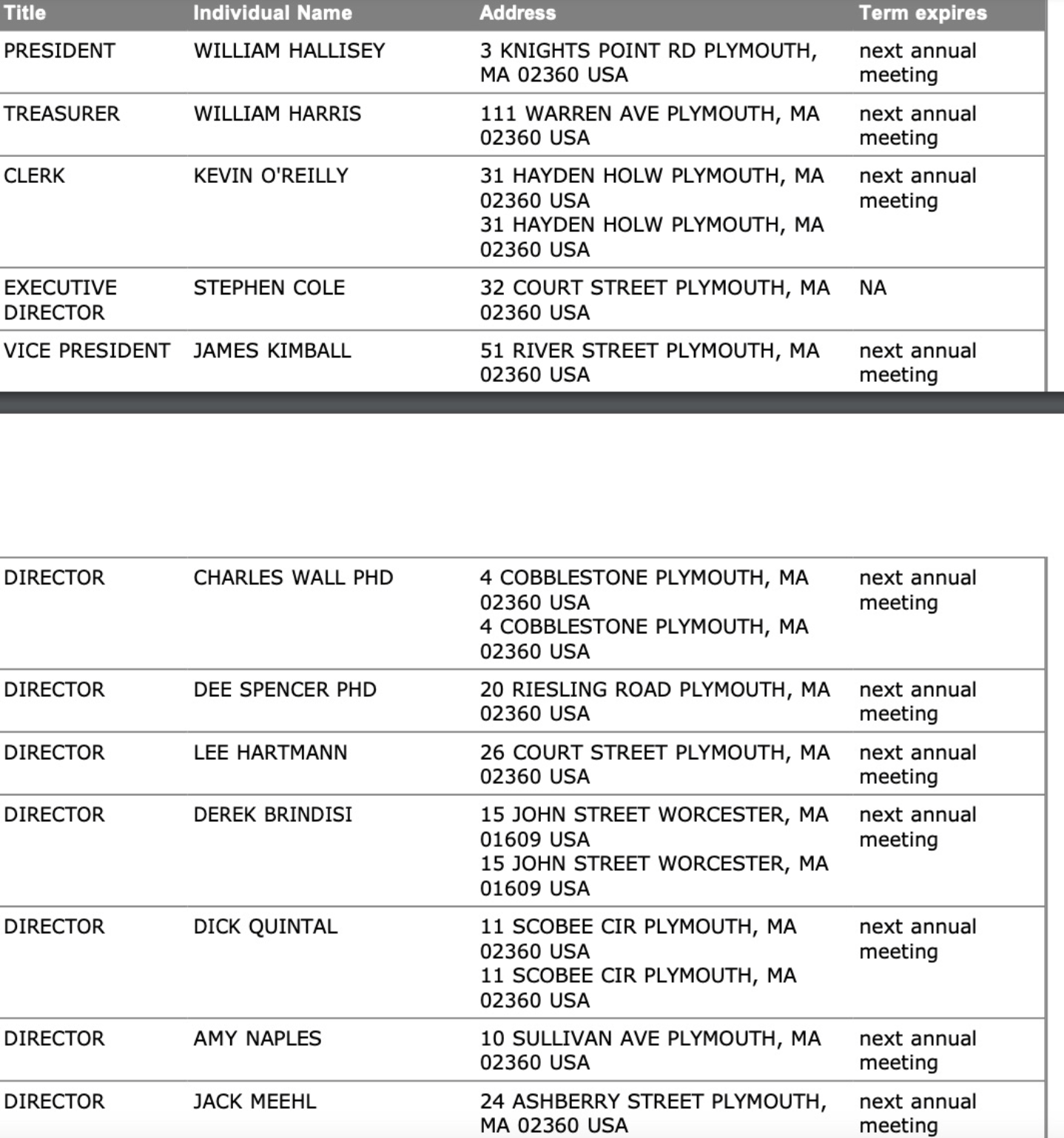

Three Town officials have permanent spots on the board of directors of the Foundation under the Foundation Bylaws. Two of them are paid town employees: the Town Manager, now Derek Brindisi and the Town Director of Planning and Economic Development, now Lee Hartman. Are these town employees working for the Foundation as part of their town jobs, with their salaries paid by taxpayers? Is this a conflict of interest? The third board position under the Foundation bylaws reserved for Town officials is the Chair of the Select Board. Today Dick Quintal, an elected Select Board member holds a position on the Foundation board of directors. Is this a conflict of interest?

See the Foundation’s list of most recent list of officer and directors of the Foundation below:

The directors include developers Rick Vayo, William Hallisey, and Dee Wallace Spencer, who is related to Scott Spencer of the sand and gravel mining project on Route 3 in Plymouth, as well as developer Tom Wallace.

Town taxpayers fund Foundation’s staff salary

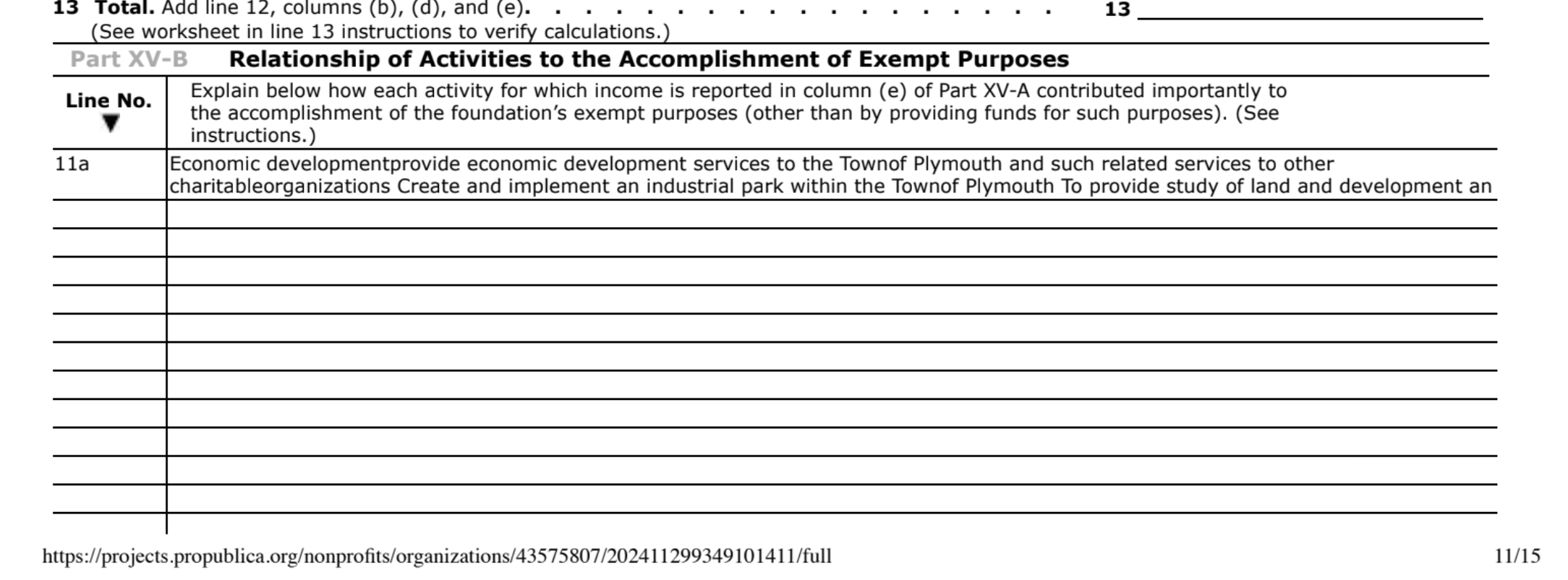

The Foundation’s tax returns say that it provides “services” to the Town of Plymouth. For example, the Foundation’s 2022 IRS 990 tax returns state under Relationship of Activities to the Accomplishment of Exempt Purposes in Part XV-8, Line 11a:

“Economic development provide economic development services to the Town of Plymouth and such related services to other charitable organizations. Create and implement an industrial park within the Town of Plymouth To provide study of land and development….”

Below: Plymouth Foundation 2022 IRS 990 tax return describing “economic development services to the Town of Plymouth.” This appears to be describing the executive director that the Town pays for.

Below: Plymouth Foundation 2014 IRS 990 tax return stating it is “currently fee for service with the Town of Plymouth, providing Economic Development Director for the Town of Plymouth”. This also identifies sand and gravel sales in 2010 for $308,333.00 and in 2011 $261,444.00.

The Town is not a “charitable organization.” There are questions about whether a private 501(c)(3) can pay the salary of what is essentially a Town employee who appears on the Planning & Development directory as “Staff.”

On September 23, 2024, CLWC submitted a request to the Town Manager under the state Public Records Law for all records showing Town payments to the Foundation since 2001, including salary for the Foundation executive director. See the request Public Records Request to Plymouth here.

Click here to se a spreadsheet containing all records of monetary compensation paid by the Town of Plymouth to the Plymouth Foundation since 2009.

Open Meeting Law Violations?

The Foundation does not comply with the state’s Open Meeting Law even though it has all the earmarks of a “public body” under the law.

The Open Meeting Law requires a “public body” to conduct its activities in public, with limited exceptions for executive sessions. The Foundation acts like a public body but has never complied with the Open Meeting Law.

On September 25, 2024, CLWC filed an Open Meeting Law complaint against the Town and the Foundation. Read it here: Open Meeting Law Compliant Sept. 25, 2024.

The Foundation and the Town have a chance to respond to the complaint. If they fail to respond, or anyone disagrees with the response, it can be appealed to the Massachusetts Attorney General’s Office, Open Meeting Law Division.

Conflicts of interest?

The state’s Conflict of Interest law prevents government employees like the Town Manager, Development Director and Selectboard members from engaging in activities that conflict with their duties to the Town. Read more about the State Ethics Commission here.